Hedging tools can also be used for locking the profit. Forex traders can be referring to one of two related strategies when they engage in hedging.

Hedging Is Not Diversification The Best Forex Signals 2019 No

Hedging Is Not Diversification The Best Forex Signals 2019 No

In this article ill talk about several proven forex hedging strategies.

Forex hedging advantages. Here are the pros and cons of hedging currencies. Hedging is a ! tool companies can use to set their risk level. For example you could buy a long position in eurusd and a short position in usdchf.

Like any other type of moneymaking approach hedging has both advantages and disadvantages. No one that hedge in any other market buys and sell same symbol. Investors in crude oil for example sometimes hedge by investing in airline stocks.

Hedging your bets reduces your risk but it usually reduces your potential gain too. It can turn out well or poorly for a company but it serves a useful purpose regardless of how things work out in the end. Ultimately to achieve the above goal you need to pay someone else to cover your downside risk.

Currency futures and options are mainly a derivative product that large financial institutions use to either hedge exposure to financial investment exposure or speculate on fx price action. Following are the various advantages of hedging. Hedging is ! a strategy to protect ones position from an adverse move in a ! currency pair.

Airlines need lots of fuel so stock prices historically rise and fall in opposition to crude oil prices. A forex trader can make a hedge against a particular currency by using two different currency pairs. In this case it wouldnt be exact but you would be hedging your usd exposure.

As an investor you need to ensure that the benefits of an investment strategy can offset the disadvantages. Here are the main advantages and disadvantages of forward contracts and currency options compared to currency forwards. That would be non sense as stated by 22 and jack in the previous posts.

The term hedging relates to offset the various risks springing in market through several types of action. Hedging means to secure against the loss from innumerable risks that rises in worldwide finance market. Futures and options are very good short term risk minimizing strategy for long term traders and investors.

!If you invest in both and the oil price drops your airline stocks will rise and mitigate the damage to your portfolio. Hedging in forex need to be treated exactly as hedging in the regulated marketsstocks. Hedging enables traders to survive hard market periods.

Forex Grid Hedge Strategy Forex Hedging Dual Grid Strategy

Forex Grid Hedge Strategy Forex Hedging Dual Grid Strategy

Insuring Against Currency Risk Assure Hedg! e

Currency Pair Correlations Forex Trading Octafx

Currency Pair Correlations Forex Trading Octafx

:brightness(10):contrast(5):no_upscale()/171998924-F-56a31b713df78cf7727bcf36.jpg) Learn About Forex Hedging

Learn About Forex Hedging

Bcv Bcv Banque Cantonale Vaudoise

Bcv Bcv Banque Cantonale Vaudoise

Hedge Finance Wikipedia

Foreign Exchange Hedging Strategies At General

Foreign Exchange Hedging Strategies At General

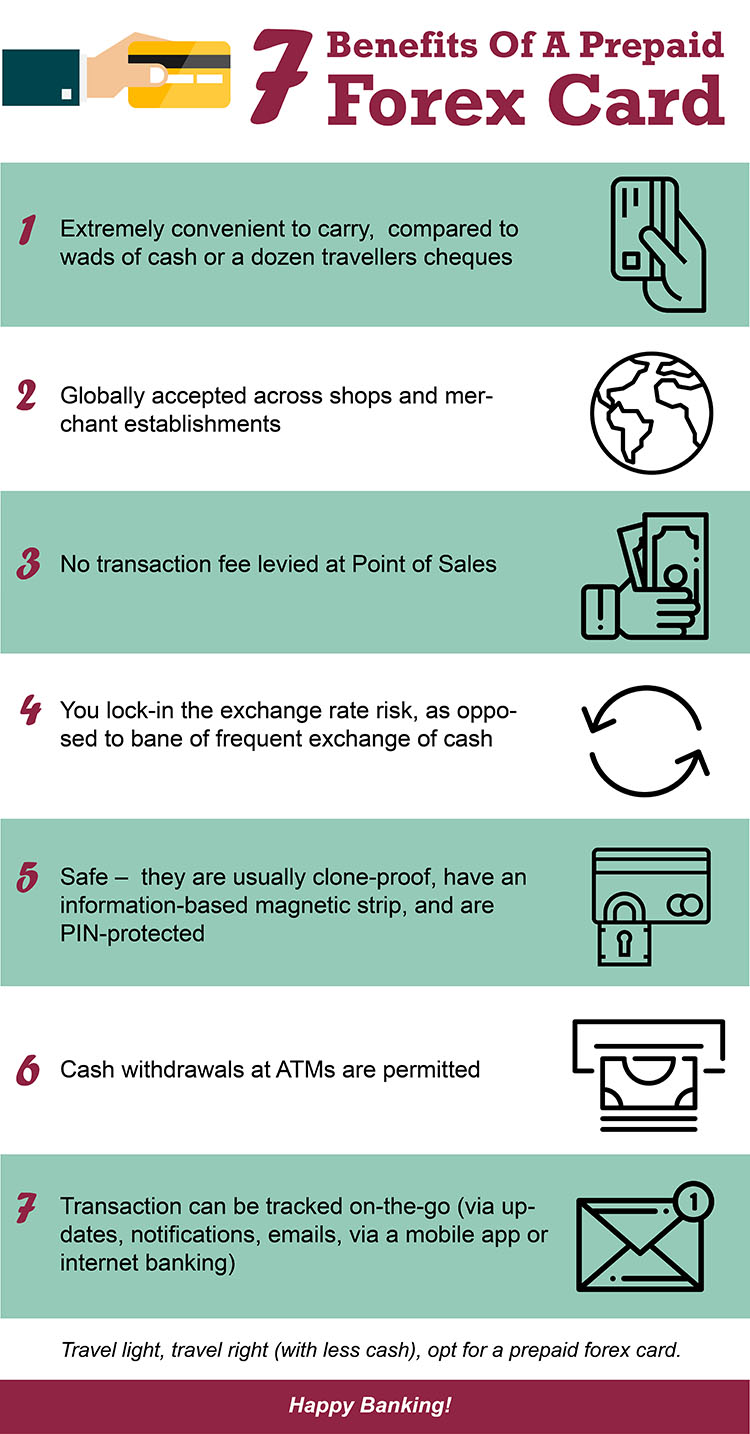

Benefits Of A Prepaid Forex Card During! An International Trip

Benefits Of A Prepaid Forex Card During! An International Trip

Robo Forex Hedging Fx 2 0 Forex Scalping Strategy System V2 0 Ea Review

Discussion Of Article Metatrader 5 Features Hedging Position

Discussion Of Article Metatrader 5 Features Hedging Position

Benefits Of Forex Trading Why Trade Forex Ig Us

Benefits Of Forex Trading Why Trade Forex Ig Us

No Stop Hedged Grid Forex Trading System Pdf Xytiyyreli Web Fc2 Com

Doc Arbitrage Speculation Hedging In Forex Market Chapter I

Doc Arbitrage Speculation Hedging In Forex Market Chapter I

Hedging Risk With Currency Swaps

Hedging Risk With Currency Swaps

The Forex Double Grid Strategy Forex Opportunities

The Forex Double Grid Strategy Forex Opportunities