Margin services try our new interactive margin calculator and evaluate initial margin requirements. You sell a 10m usdcad put option.

Us Margin Requirements Oanda

Forwards also typically have no interim partial settlements or true ups in margin requirements like futures such that the parties do not exchange additional property securing the party at gain and the entire unrealized gain or loss builds up while the contract is open.

Currency forward margin require! ment. Market participants are inundated with regulatory requirements and deadlines to work towards however one such deadline coming up is the emir margin requirement for physically settled fx forwards which comes into force january 3 2018. I will use the section on cross currency swaps to estimate how much initial margin may be posted over time. Currency forward settlement can either be on a cash or a delivery basis provided that the option is mutually acceptable and has been specified beforehand in the contract.

So if you buy 100000 worth of currency you are not depositing 2000 and borrowing 98000 for the purchase. The margin requirement is therefore calculated as the notional amount multiplied by the prevailing spot margin requirement. Margin requirements for non centrally cleared derivatives the basel committee on banking supervision in conjunction with the board of iosco published this paper in march 2015.

The margin! requirement will be the maximum future loss of 71429 usd 10m ! x 142 141 100000 cad usd at 140. The requirements of the final margin rule apply to swaps which encompass almost all contracts defined as otc derivatives in regulation eu no 6482012 with the exception of foreign exchange forwards and foreign exchange swaps for which the final margin rule sets no requirements. The 2000 is to cover your losses.

Find out more about the margin requirements for uncleared derivatives under emir and changes introduced by emir refit. The difference between the two rates can either be a premium or a. You have an unlimited downside risk.

The forward margin reflects the difference between the spot rate and the forward rate for a certain commodity or currency. Thus buying or selling currency is like buying or selling futures rather than stocks. The margin requirement can be met not only with money but also with profitable open positions.

The margin requirements under emir require counter! parties who are in scope to exchange margin on their over the counter otc derivatives contracts that are not cleared through a central counterparty ccp.

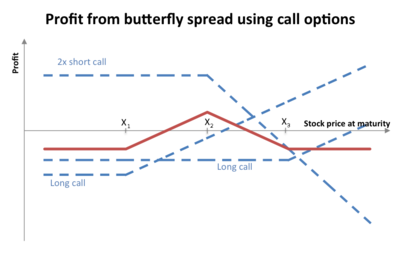

Butterfly Options Wikipedia

Butterfly Options Wikipedia

Margin Requirements

Margin Requirements

Central Counterparty Margin Frameworks Bulletin December Quarter

Central Counterparty Margin Frameworks Bulletin December Quarter

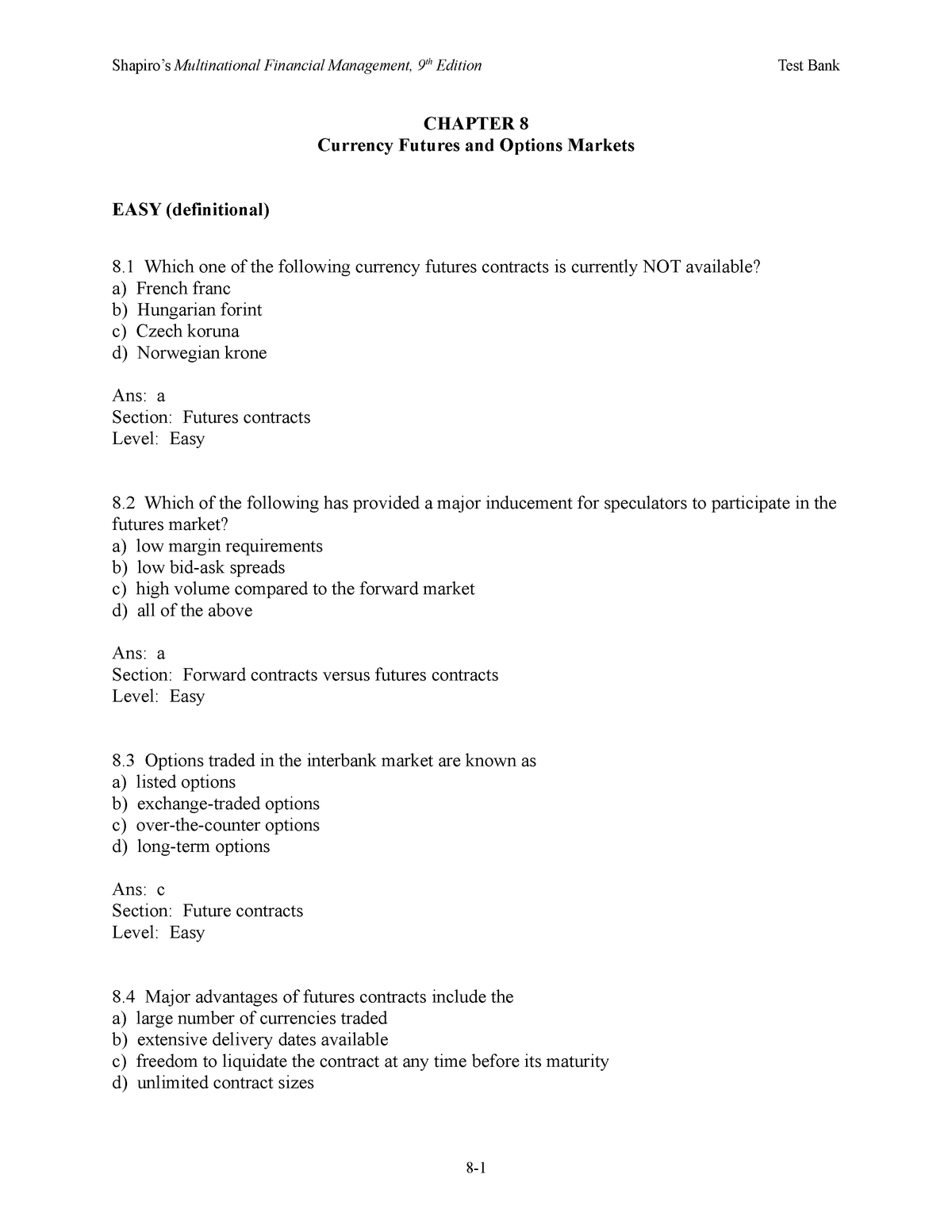

08 Ch08 04 72 271 Business Finance Ii Studocu

08 Ch08 04 72 271 Business Finance Ii Studocu

Foreign Currency Derivatives And Swaps Ppt Video Online Download

Foreign Currency Derivatives And Swaps Ppt Video Online Download

C H A P T E R 5 Currency Derivatives Ppt Video Online Download

C H A P T E R 5 Currency Derivatives Ppt Video Online Download

/wall_street_179681980-5bfc2b9746e0fb0083c07d29.jpg) Currency Forward Definition

Currency Forward Definition

Hedging Vs Forward Contracting Ag Decision Mak! er

Hedging Vs Forward Contracting Ag Decision Mak! er

Final Phases Of Initial Margin Requirements For Uncleared Swaps

Final Phases Of Initial Margin Requirements For Uncleared Swaps

Currency Futures An Introduction

Differences Between Future And Forward Contracts Tradingsim

Differences Between Future And Forward Contracts Tradingsim

Dukascopy Bank Sa Swiss Forex Bank Ecn Broker Managed Accounts

Dukascopy Bank Sa Swiss Forex Bank Ecn Broker Managed Accounts

Margin For Otc Derivatives October 2016 Ashurst

Margin For Otc Derivatives October 2016 Ashurst

Initial Margin Phase 5

How To Spread Bet On Shares Forex And More Spread Bet Calculator

How To Spread Bet On Shares Forex And More Spread Bet Calculator