Backtesting worked like a charm at a 13 increase of earnings and production lost every single trade. Lets say you have an idea for a trading strategy and youd like to evaluate it with historical data and see how it behaves.

Backtrader Bollinger Mean Reversion Strategy Backtest Rookies

Backtrader Bollinger Mean Reversion Strategy Backtest Rookies

My secret yet simple way to backtest any trading strategy easily backtesting tradingview have you ever wondered how you could start backtesting a trading strategy in a short period of time.

! Forex backtesting python. Of course past performance is not indicative of future results but a strategy that proves itself resilient in a multitude of market conditions can with a little luck remain. I figured it out after my algo lost 3400 in a couple of hours a very expensive lesson. In this article frank smietana one of quantstarts expert guest contributors describes the python open source backtesting software landscape and provides advice on which backtesting framework is suitable for your own project needs.

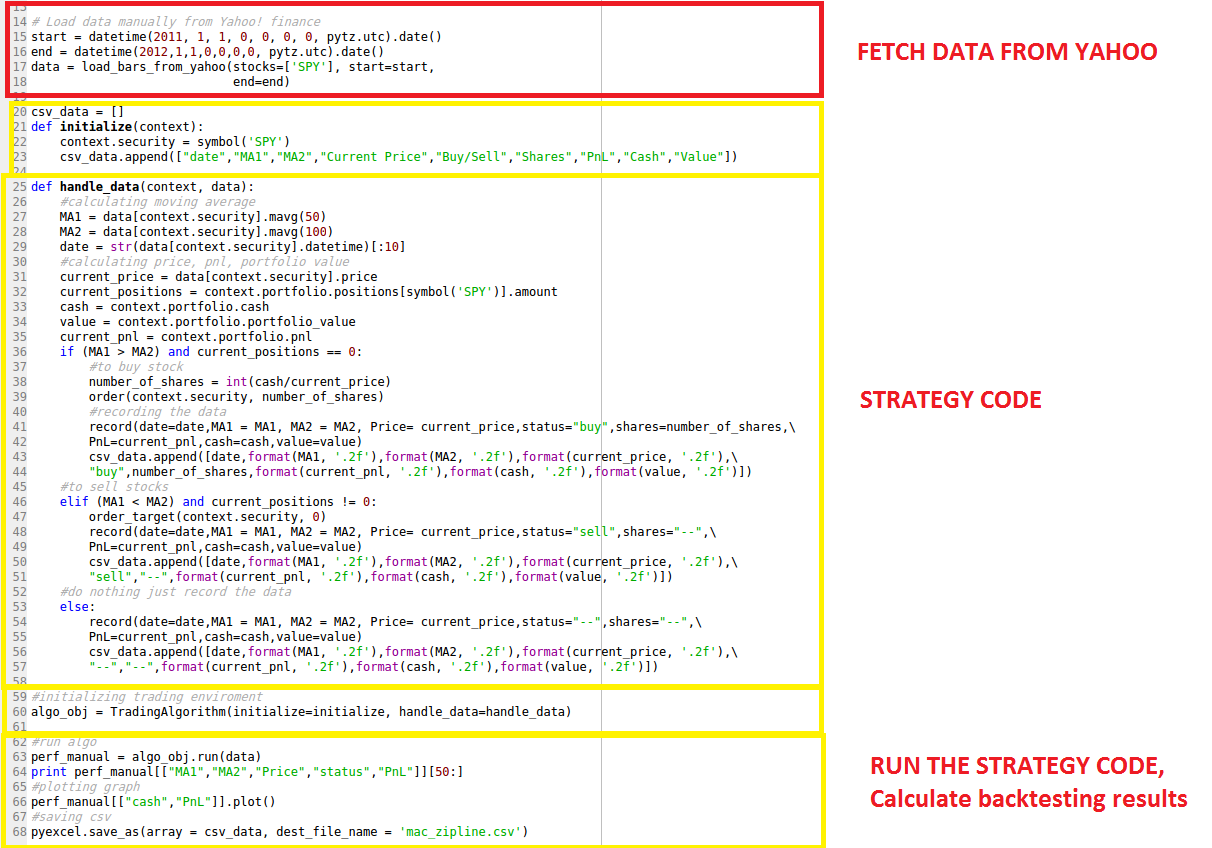

This framework allows you to easily create strategies that mix and match different algos. Bt is a flexible backtesting framework for python used to test quantitative trading strategies. Backtesting is the process of testing a strategy over a given data set.

An event driven library which focuses on backtesting and supports paper trading and live trading. Here are few of the python libraries which you ca! n use for backtesting. For example quantopian a web based and ! python powered backtesting platform for algorithmic trading strategies reported at the end of 2016 that it had attracted a user base of more than 100000 people.

This blog post is going to deal with creating the initial stages of our python backtesting mean reversion script were going to leave the symbol pairs function we created in the last post behind for a bit well come back to it a bit later and use a single pair of symbols to run our first few stages of the backtest to keep it simple. Python algorithmic trading library pyalgotrade is a python algorithmic trading library with focus on backtesting and support for paper trading and live trading. Backtestingpy is a python framework for inferring viability of trading strategies on historical past data.

I figured it out after my algo lost 3400 in a couple of hours a very expensive lesson. For your back testing there is a simple way of downloading massive data files into your strateg! y or a large number of simulated trading days smaller files to perform a pl based upon roi of these daysprofiles bullish bearish reversals flat.

Qstrader Event Driven Backtesting Engine Quantstart

Qstrader Event Driven Backtesting Engine Quantstart

Importing Csv Data In Zipline For Backtesting

Importing Csv Data In Zipline For Backtesting

Using Python For Backtesting Intraday Futures Trading Strategy

Using Python For Backtesting Intraday Futures Trading Strategy

Python Backtesting Forex Oh No Not Another Python Backtester

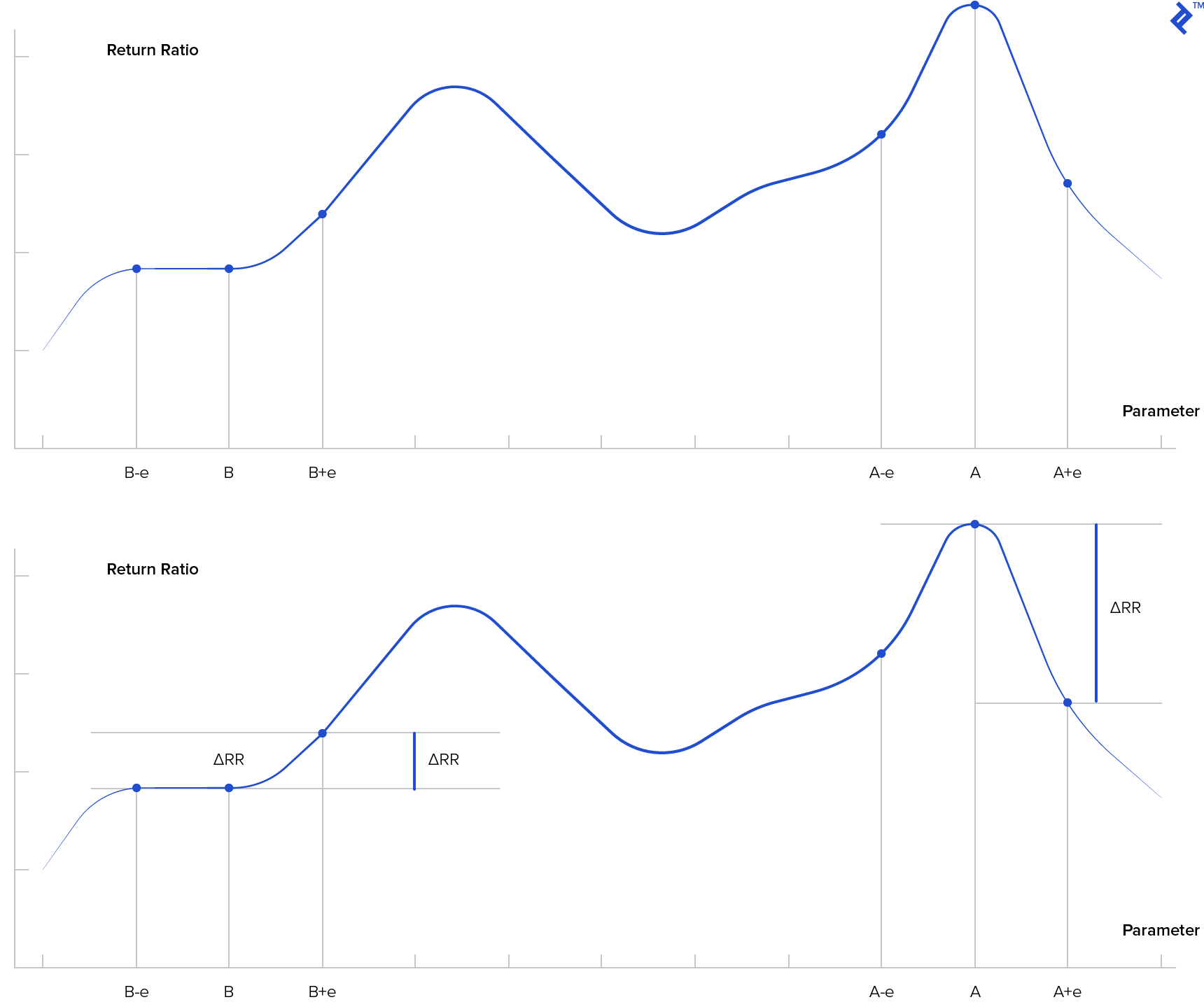

Algorithmic Trading Backtest Optimize Automate In Python Udemy

Algorithmic Trading Backtest Optimize Automate In Python Udemy

Stock Data Analysis With Python Second Edition Curtis Miller S

Investieren Und Traden Mit Python Lernen Das Testen Einer Ersten

Investieren Und Traden Mit Python Lernen Das Testen Einer Ersten

Forex Algorithmic Tradin! g Strategies My Experience Toptal

Forex Algorithmic Tradin! g Strategies My Experience Toptal

Forex Python Trading With Python Fxcm Uk

Forex Python Trading With Python Fxcm Uk

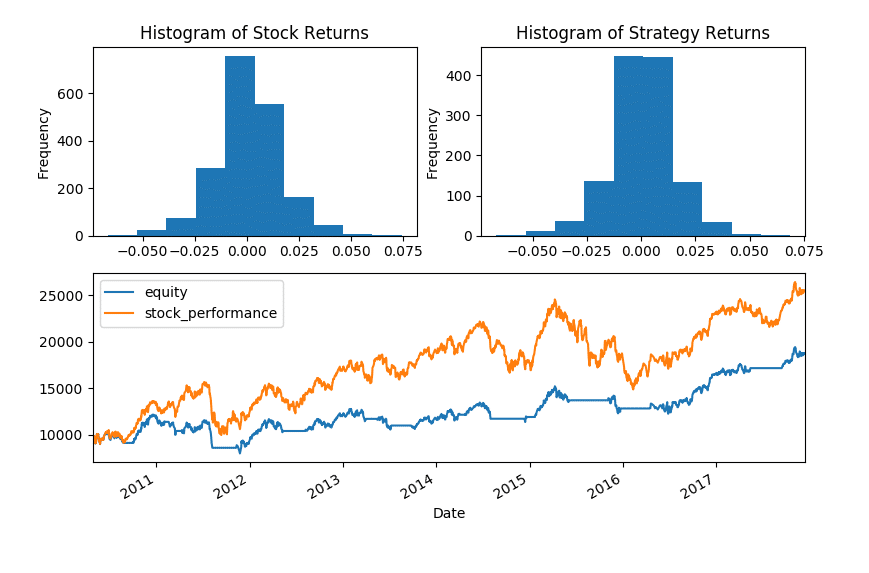

Backtesting A Moving Average Crossover In Python With Pandas

Backtesting A Moving Average Crossover In Python With Pandas

Investieren Und Traden Mit Python Lernen Das Testen Einer Ersten

Investieren Und Traden Mit Python Lernen Das Testen Einer Ersten

Python For Finance Algorithmic Trading Article Datacamp

Python For Finance Algorithmic Trading Article Datacamp

Forex Backtesting Python Algorithmic Trading In Less Than 100 Lines

Popular Python Trading Platforms For Algorithmic Trading

Popular Python Trading Platforms For Algorithmic Trading

Eden Mark I Will Design A Backtesting System For Your Forex In Python Desktop App For 700 On Www Fiverr Com

Eden Mark I Will Design A Backtesting System For Your Forex In Python Desktop App For 700 On Www Fiverr Com